Our Approach

We don't just find you a loan.

We make sure you're ready for one.

Commercial lending has gotten more rigorous every year. The support available to borrowers hasn't kept up. That's the gap we fill.

The Lending Reality

Commercial lending isn't a car loan. It's an investment decision.

When a bank makes a commercial loan, they're investing their depositors' money into your business. They treat it that way. It's not enough to check your credit score and income — they dig into the financials, cross-check every document, and need to see that you understand how to run a successful operation. Their investment depends on your success.

Over the decades, this rigor has only gotten tighter. More documentation. More scrutiny. More requirements. That's not unreasonable — it's responsible. But it means the bar keeps rising for borrowers.

Meanwhile, you're doing what you should be doing — running your business, serving your customers, building something. Nobody expects you to become a lending expert on top of everything else.

A typical loan package includes:

This isn't a complete list. Requirements vary by loan type, industry, and lender.

The Difference

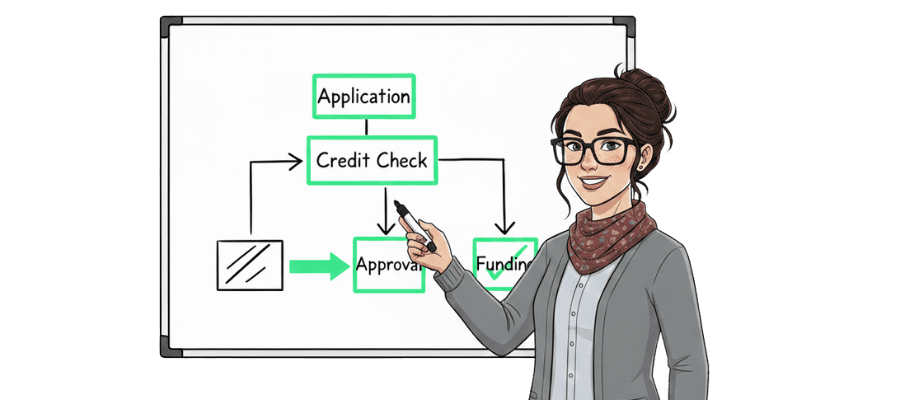

What the lending experience actually looks like

Two paths. Same goal. Very different outcomes.

The cost of going it alone:

Broker fees of $10K–$20K+ at closing. Months of wasted time. Bad terms that cost thousands over the life of the loan. Or worse — no loan at all.

The Zero2Ten difference:

You pay for the work that gets you funded — not a fee at closing. And if you're not ready today, we don't walk away. We build the path forward.

How We Bridge the Gap

Tools. Education. Guidance. Advisory.

We give you the map, teach you to read it, and walk the path with you.

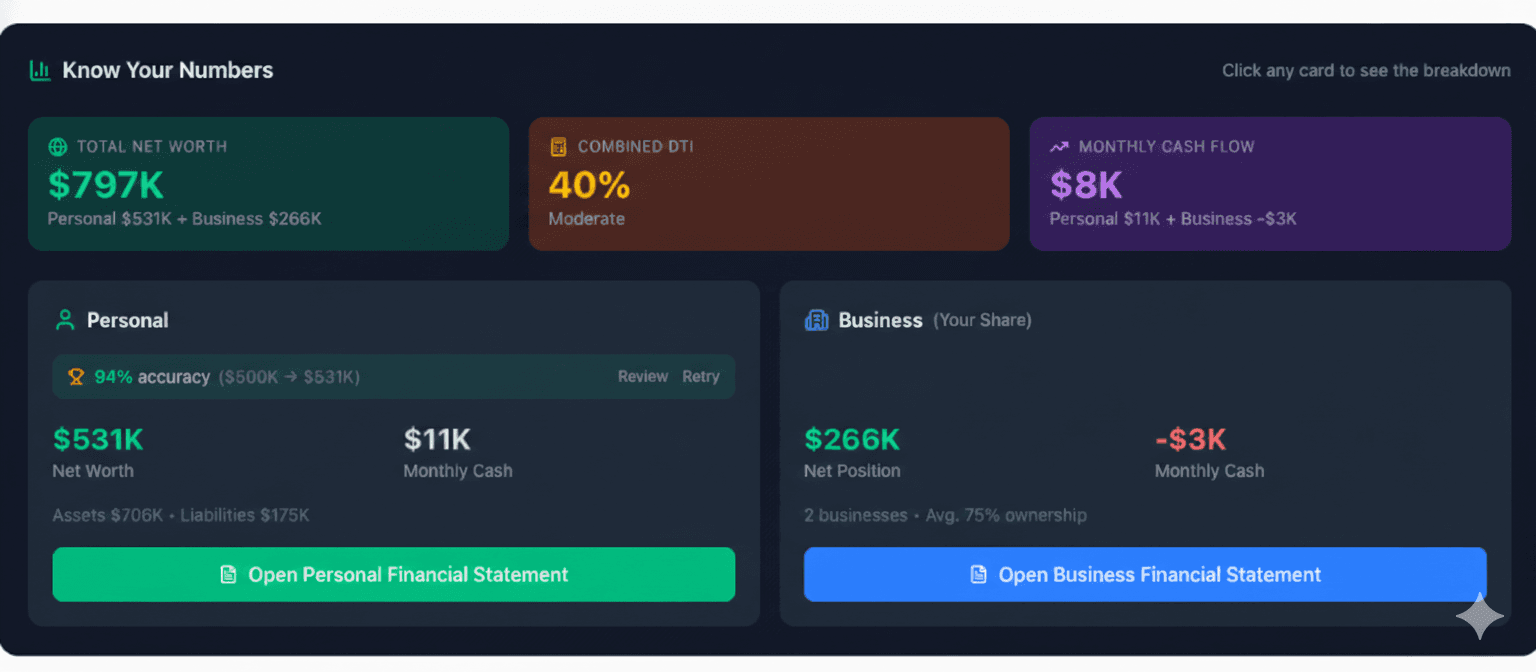

Zero2Ten HQ

The hardest part of commercial lending is getting everything together. Tracking down documents, building financial statements, organizing it all the way lenders expect to see it — all while still running your business.

Zero2Ten HQ is our platform, built specifically for this problem. It's where your entire lending journey lives — from the first document you upload to the final package you submit.

Stop scrambling. Start prepared.

Not sure where to begin? Start with our free Borrower's Cheatsheet — every document, term, and metric you'll encounter.

What HQ does for you:

Secure storage for every document in your loan package. Upload once, organized automatically, always accessible.

Build your Personal Financial Statement, Business Financial Statement, and other required documents directly in the platform.

See your business the way a lender sees it. Cash flow analysis, debt service coverage, and key ratios — explained in plain English.

When you're ready, your entire loan package is organized, formatted, and ready to submit. Nothing missing, nothing out of place.

Always know where you stand. What's done, what's missing, and what's next — all at a glance.

What you'll learn:

Get notified when training launches:

Know the Game

You wouldn't step onto a football field without knowing the rules. You wouldn't show up to a chess match without understanding how the pieces move. But that's exactly what most business owners do when they apply for a commercial loan.

Our training programs dive deep into how commercial lending actually works. Not theory — practical, actionable knowledge that changes how you see your business and how lenders see you.

When you understand the game, you can play the game. You know what numbers matter. You know what questions are coming. You know why the bank asks for what they ask for — and you're ready with answers.

Stop stepping on the field without the rules or a game plan.

Coaching That Keeps You on Track

Tiger Woods has a swing coach. Steph Curry has a shooting coach. The best in the world know that expert guidance is the fastest path to consistent success — not because they can't do it alone, but because having someone reviewing your work and keeping you accountable makes all the difference.

Our Guidance tier is exactly that. You're doing the work — collecting documents, building your financials, preparing your package. We're reviewing it at key milestones, giving you feedback, answering your questions, and making sure you stay on track.

You drive. We navigate.

What Guidance includes:

Submit your documents at key stages. We review them, flag issues, and tell you exactly what needs to change before a lender sees it.

Scheduled reviews to assess progress, reprioritize if needed, and make sure nothing stalls out or falls through the cracks.

Questions come up. We respond within one business day — not next week, not when we get around to it.

When you're ready to submit, you have access to our network of lenders who know the Zero2Ten standard of preparation.

What Advisory includes:

Kickoff meeting with all owners (20%+ ownership). Individual account setup and onboarding for each owner.

We work with each owner individually to build their Personal Financial Statement and business financials — correctly, completely, and lender-ready.

We analyze your package the way a bank will. Looking for discrepancies between your PFS, tax returns, and credit reports. Catching issues before a lender does.

Credit issues, gaps in employment, business losses — banks will ask. We help you write clear, honest explanations that address concerns head-on.

We review and give feedback on your business plan and financial projections so they tell the right story backed by real numbers.

When a term sheet comes in, we review it with you. Then we ensure all term requirements — appraisals, environmentals, insurance, and more — get completed.

We sit in meetings with the bank, SBA, and CDC alongside you. Every request from lenders and SBA gets logged and fulfilled. Nothing gets missed.

Co-lending, bridge lending, syndications — when the deal structure gets complicated, we manage the coordination across all parties.

Direct access to our lending network. When lenders see a Zero2Ten package, they know it's been pre-underwritten, organized, and ready. They look forward to working with our clients.

An Extension of Your Team

Guidance keeps you on track. Advisory puts someone in the seat next to you. This is hands-on, start-to-finish engagement management for business owners who want the highest level of support — and the best possible outcome.

Your dedicated account rep manages the entire lending process. They set up every owner, build the financials with you, pre-underwrite the package looking for the same discrepancies a bank will find, prepare you for hard questions, and sit alongside you in meetings with lenders, SBA, and CDCs.

When the term sheet arrives, we review it together. When appraisals, environmentals, and insurance need to happen, we coordinate it. When the deal structure is complex — co-lending, bridge financing, syndications — we manage every moving piece.

This isn't coaching with extra steps. It's a fundamentally different level of service.

What Happens When You're Not Ready

Everyone else disappears.

We're just getting started.

Here's what happens at every other firm when you don't qualify: the broker stops returning calls. The bank sends a form letter. The online lender redirects you to a higher-rate product. Nobody tells you WHY you were rejected or WHAT to do about it.

At Zero2Ten, "not ready" isn't a dead end — it's a starting point. We show you exactly where the gaps are, build a roadmap to close them, and give you the tools and support to get there. Our HQ platform tracks your progress. Our advisory team keeps you accountable. And when you're ready, our lending network is waiting.

Every business has a path to funding. Some paths are longer. We walk them all.

We show you exactly what's standing between you and funding — credit, cash flow, documentation, business maturity, or something else entirely.

A step-by-step plan tailored to your situation. Not generic advice — specific actions with specific timelines.

Zero2Ten HQ tracks your progress. Training builds your knowledge. Advisory keeps you accountable and moving forward.

When you're ready, your package is prepared, your story is clear, and our lending network is excited to review it.

Putting It All Together

Four pillars. Three levels. One goal.

Tools, education, guidance, and advisory aren't separate products — they're layers. The level you choose determines how much of each you get.

Self-Service

You use the tools. HQ gives you document management, financial statement generation, and lending insights. You learn at your own pace. You build the package yourself. When you're ready, you have access to our lending network.

Guided

You get the tools plus education and coaching. An advisor reviews your documents at key milestones, gives you feedback, answers your questions, and keeps you on track with 24-hour email support. You do the work — we make sure you're doing it right.

Full Advisory

The full stack. A dedicated account rep manages the entire engagement from kickoff to closing — PFS and financial setup with each owner, pre-underwriting, blemish response support, business plan review, term sheet review, lender and SBA meetings alongside you, and coordination of complex structures like co-lending and syndications.

Ready to find out where you stand?

Take the free assessment. 60 seconds. No signup. No commitment.