Personal Documents You'll Need

If you own 20% or more of the business, lenders need to verify who you are, your financial history, and your ability to support the loan. Every owner meeting this threshold provides these documents.

Personal Tax Returns (3 years)

Full 1040 with ALL schedules. Lenders look at Schedule C (sole proprietor income), Schedule E (rental/partnership income), and K-1s. Make sure they match IRS records. If you amended any returns, include the amendments.

Personal Bank Statements (3 months)

All accounts: checking, savings, investments. Used to verify cash on your Personal Financial Statement and trace the source of your down payment. Heads up: large deposits will need documentation of where the money came from.

Personal Financial Statement (SBA Form 413)

A complete snapshot of everything you own vs. everything you owe. Must include spouse if applicable. Common mistakes: leaving off liabilities that show on your credit report, inconsistent values, and math errors. Tip: The lender WILL compare this to your credit report — inconsistencies raise red flags.

Government-Issued Photo ID

Valid, unexpired driver's license or passport for every owner.

Resume

Highlights your relevant business and industry experience. Lenders want evidence you can actually run this business.

Schedule of Real Estate Owned

Every property you own: address, type, market value, mortgage balance, equity position. Properties with 25%+ equity may have liens placed on them as additional collateral.

Proof of Equity Injection

Documentation showing where your down payment is coming from. Funds must be "seasoned" (sitting in your account for 60-90+ days). They can't be borrowed money. This is one of the most common sticking points — start earmarking funds now.

Social Security Card

Some lenders require it for identity verification.

Business Documents You'll Need

These tell the story of your company — its history, its finances, and its legal standing.

Business Tax Returns (3 years)

Form 1120 (C-Corp), 1120-S (S-Corp), or 1065 (Partnership). Include all schedules and K-1s issued to owners. Less than 3 years in business? Provide what you have — but expect to need stronger projections.

Year-to-Date Profit & Loss Statement

Shows revenue minus expenses over a period. Must be dated within 120 days of submission. Should reconcile with your tax returns — if your P&L shows $500K revenue but your tax return shows $400K, that's a problem.

Year-to-Date Balance Sheet

Snapshot of what the business owns and owes on a specific date. Also must be within 120 days.

Business Bank Statements (3 months)

All business accounts. Shows cash flow patterns and average balances.

Business Debt Schedule

Every loan, line of credit, lease, and recurring obligation. For each: who you owe, original amount, current balance, monthly payment, interest rate, and maturity date. This feeds directly into your DSCR calculation — the most important number in the process.

Articles of Incorporation / Organization

Proves your business is a real, legally formed entity.

Operating Agreement or Bylaws

Must reflect current ownership percentages. If it hasn't been updated, do it now — lenders will compare this to what you report on your application.

EIN Verification Letter

IRS CP 575 or 147C.

Certificate of Good Standing

From your state. Proves your entity is active and in compliance.

Borrower Information Form (SBA Form 1919)

The master application form. Captures business info, ownership details, and how loan proceeds will be used. Required for SBA-backed loans.

Additional Documents (Depending on Your Loan Type)

Not every loan is the same. Depending on what you're doing, you may also need...

Real Estate Purchases

- Purchase agreement or letter of intent

- Property appraisal (the lender orders this, but budget $3,000-$7,000+)

- Phase I Environmental Assessment ($2,000-$4,000)

- Existing lease agreements and rent rolls (if tenants)

Business Acquisitions

- Purchase agreement or Asset Purchase Agreement

- Business valuation

- Seller's tax returns and financials (2-3 years)

- Seller's reason for sale

- Franchise agreement (if applicable)

Financial Terms Every Borrower Needs to Know

Lenders use these terms constantly. If you don't understand them, you're negotiating in the dark.

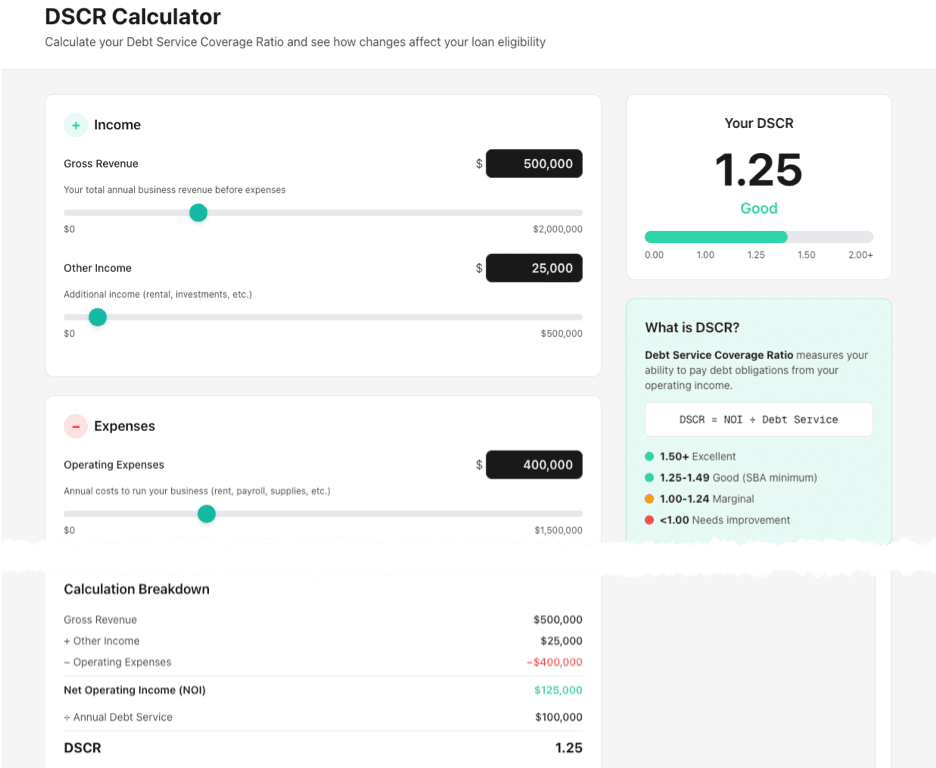

Your business income divided by your total debt payments. If your business earns $125,000 and total debt payments are $100,000, your DSCR is 1.25x. Most lenders want at least 1.25x — meaning $1.25 of income for every $1.00 of debt.

This is the single most important number in the entire process. If the math doesn't work here, nothing else matters.

Your total monthly personal debt payments divided by your gross monthly income.

High DTI signals you're personally stretched thin, even if the business is healthy.

Revenue minus operating expenses, before debt payments and taxes.

This is the top number in your DSCR calculation. Higher NOI = stronger loan case.

A common way to measure cash flow. Lenders add back non-cash expenses like depreciation to see the true earning power of your business.

Shows the actual cash-generating ability of your operations.

Your combined income from ALL sources — business profits, personal salary, rental income, spouse's income.

Lenders look at the full picture, not just the business. This can help you (spouse has a strong W-2) or hurt you (personal debts drag down the numbers).

Your skin in the game. Typically 10-20% of the total project cost. Must come from verified, seasoned funds — can't be borrowed.

This is where a lot of deals stall because borrowers can't prove the source or haven't let the money sit long enough.

Assets pledged to secure the loan — real estate, equipment, inventory, accounts receivable.

Lenders are required to collateralize to the maximum extent possible. Real estate with significant equity is the strongest form.

The loan amount divided by the appraised value of the collateral.

Lower LTV = less risk for the lender = better terms for you.

How Lenders Actually Decide

Every lender — whether they say it explicitly or not — evaluates your loan request through five lenses. Understanding them puts you in control of the conversation.

Capacity

Can you repay?

This is your DSCR, your cash flow history, and your projections. It's the #1 factor. If the math doesn't work, nothing else saves the deal.

Credit

Have you repaid before?

Lenders pull personal and business credit reports. They're looking for patterns: late payments, collections, bankruptcies, and your overall scores. One bad mark isn't a dealbreaker — but you'd better have an explanation letter ready.

Capital

Do you have skin in the game?

Your equity injection, personal net worth, and liquid assets. Lenders want to see that you're personally invested, not borrowing 100% of the project cost.

Collateral

What secures the loan?

Real estate, equipment, inventory. Lenders want backup if things go wrong. SBA won't decline solely on a collateral shortfall, but it's still a factor.

Character

Can they trust you?

Your experience, your resume, the quality of your business plan, and frankly, how you show up during the process. Are you responsive? Organized? Honest about weaknesses? This one is more subjective, but it matters more than people think.

SBA Loan Programs — A Quick Overview

If you're pursuing an SBA-backed loan, here are the main programs. Each has different rules, limits, and best-fit scenarios.

SBA 7(a)

Up to $5 million

The most versatile program: working capital, equipment, real estate, debt refinancing, acquisitions. Variable or fixed rates. Up to 25 years for real estate, 10 for equipment and working capital.

Best for: General business needs

SBA 504

Up to $5.5 million

Best for major fixed assets — real estate and heavy equipment. Unique two-part structure: a bank loan + a CDC (Certified Development Company) loan at a below-market fixed rate. Must create or retain jobs.

Best for: Real estate & heavy equipment

SBA Microloan

Up to $50,000

For smaller needs: inventory, supplies, equipment, working capital. Through nonprofit intermediary lenders. Terms up to 6 years.

Best for: Startups and newer businesses

SBA Express

Up to $500,000

Faster SBA turnaround (36 hours vs. weeks). Less paperwork, but higher guarantee fees.

Best for: Smaller, straightforward requests

Note: SBA programs have specific eligibility requirements that change periodically. This is a general overview — your specific situation determines which programs fit.

8 Reasons Business Loans Get Declined

Most declines aren't surprises — they're predictable problems that could have been caught and fixed before submission. Here's what kills deals.

1. The Numbers Don't Work (Weak DSCR)

Your cash flow can't support the new debt on top of existing obligations.

Know your DSCR before you apply. Identify addbacks — depreciation, one-time expenses, owner compensation adjustments. If you're truly below 1.0x, you may need to restructure the deal or wait.

2. Incomplete or Messy Documentation

Missing pages, unsigned forms, financials older than 120 days, illegible copies.

Use a checklist. Verify every document is complete, signed, dated, and within required timeframes. One person should own the package review.

3. Credit Problems

Low scores, recent late payments, collections, judgments, bankruptcy.

Pull your own credit reports before a lender does. Write explanation letters for every derogatory item. Show what changed and why it won't happen again.

4. Equity Injection Issues

You can't prove where your down payment comes from, or the funds haven't been in your account long enough.

Start setting aside funds NOW. Move money early so it seasons for 60-90+ days. Document every source. Gift funds need gift letters.

5. Vague Use of Funds

"I need money to grow my business" tells a lender nothing.

Build a detailed Sources & Uses breakdown. Every dollar needs a specific destination. If you can't explain exactly how the money will be used, you're not ready.

6. Tax Problems

Unfiled returns, tax liens, or outstanding balances with the IRS or state.

File everything. Set up payment plans for anything owed. You must be current on all federal, state, and local taxes — this is non-negotiable.

7. Inconsistencies Across Documents

Your application says $350K but your narrative says $400K. Ownership percentages don't match between your operating agreement and Form 1919.

Cross-reference every number across every document. Loan amount, ownership splits, revenue figures, debt balances — they all need to match everywhere.

8. Industry or Business Risk Factors

Some businesses face higher scrutiny: restaurants, startups without revenue history, cannabis-adjacent businesses, highly seasonal operations.

Know your industry's reputation with lenders. Prepare a stronger narrative, more documentation, and more realistic projections than you think you need.

How Long Does Getting a Business Loan Actually Take?

The honest answer: longer than you want. But the timeline changes dramatically depending on how you approach it.

Plan for 3-5 months start to finish

The difference isn't luck — it's preparation, experience, and the right tools. Zero2Ten exists to make this process what it should be: manageable.

Want the Quick Reference Version?

This guide covers everything. If you want a condensed, printable cheatsheet to keep on your desk while you prepare, grab the Borrower's Cheatsheet.

Get the Borrower's Cheatsheet

Where to Go From Here

"How Lendable Am I?"

Take our free 5-minute assessment and see how a lender would evaluate you today.

Start Assessment"Talk to an Advisor"

Have questions about your specific situation? Book a free call with our team.

Book a Call"Explore Free Tools"

Calculators, templates, and more resources to help you prepare.

View Resources